Commodities & Diversification

- sebastienpautrot

- 5 hours ago

- 3 min read

26 January 2025

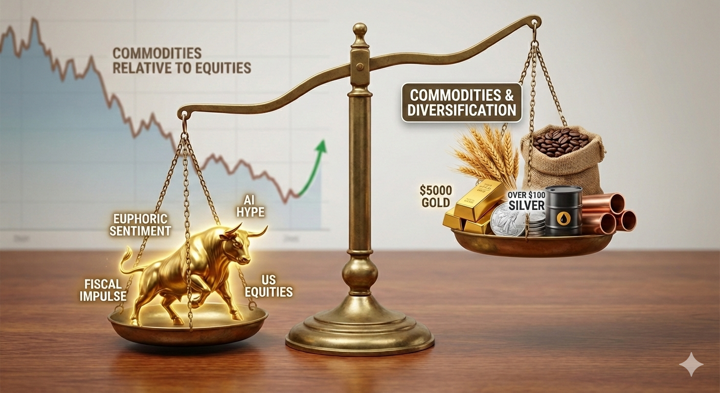

Markets are facing a pivotal moment. Optimism over the prospects for the United States in 2026 remain euphoric. As we noted last week, equity investor sentiment is near bullish extremes according to Bank of America’s survey and cash levels in mutual funds are near cycle lows (3.3%). However, near term growth momentum appears reliant on the fiscal impulse, wealth effects (asset prices) and business investment (AI). The pace of technology investment is already brisk and is expected to build on that high base. Elevated and reflexive equity valuations drive consumption growth which is disproportionately reliant on high income households. From our vantage point, breadth in the expansion remains quite narrow and the labour market remains quite weak creating tension for the path of short-term interest rates.

The US FOMC meets this week. The consensus belief is for the Committee to leave policy unchanged and offer little insight on forward guidance. The press conference might be spicy given the DOJ investigation, transition to a new Fed Chairman and potential for more dovish leadership. As we also noted last week, investor sentiment has turned bearish on longer dated US Treasury yields. That was likely driven by shifting views about the path of short-term interest rates and economic optimism noted above. The bond market episode in Japan this week also likely amplified bearish sentiment on long end yields. That was also driven by fiscal stimulus and medium-term debt sustainability.

There are two near term positives for the bond market. First, the non-trivial weakness in the labour market that ought to reduce forward looking inflation pressure. Second, the largest component of the consumer price index – shelter – suggests that inflation ought to slow materially over the coming months (chart 1). The shelter component of the CPI lags house prices and actual rents (measured by more timely surveys by Zillow).

Chart 1

Source: Bloomberg

Trumpflation – an index of real-time, daily indices – also suggests that inflation has slowed sharply to around 1.2% over the past two months (chart 2). Of course, the US Administration’s desire to “run it hot” and maintain the fiscal contribution to growth via tax cuts and spending measures is the upside risk to final demand and inflation.

Chart 2

Source: Bloomberg

For equities, investors will also focus their attention back on the corporate results for the major technology companies this week. It is notable that the NASDAQ is modestly lower since the end of October 2025 and has materially lagged the major technology companies in Asia. The market also appears to be more discriminating within the sector over the past few months especially where the business is contestable, low margin or heavily financed by leverage. If returns on capital disappoint, equity prices are vulnerable to a correction given euphoric valuation. The good news is this might support a further large rotation out of US equities and into Asia which still trades at a 40% discount to MSCI world equities.

The other large macro anomaly has been the long term out-performance of equities relative to commodities (Chart 3). The underperformance is prominent given the inflation regime since 2020. Historically, major periods of high inflation have been accompanied by phases of commodity price out performance. To be fair, there has clearly been strong performance in precious metals over the past year. On Friday spot gold hit $5000 and spot silver closed above $100.

Chart 3

Source: Bloomberg

As we discussed last week, that is most likely a brutal assessment of the fiscal outlook for the advanced economies and fiat currency. However, tactically, price has already become parabolic. Notwithstanding the outstanding performance of precious metals, there is a strong case for diversification into commodities. Note that the major spikes in the relative performance of commodities have coincided with major inflation and market shocks.

Comments