AI & the Spiraling Cost Model

- sebastienpautrot

- Jul 31, 2025

- 3 min read

31 July 2025

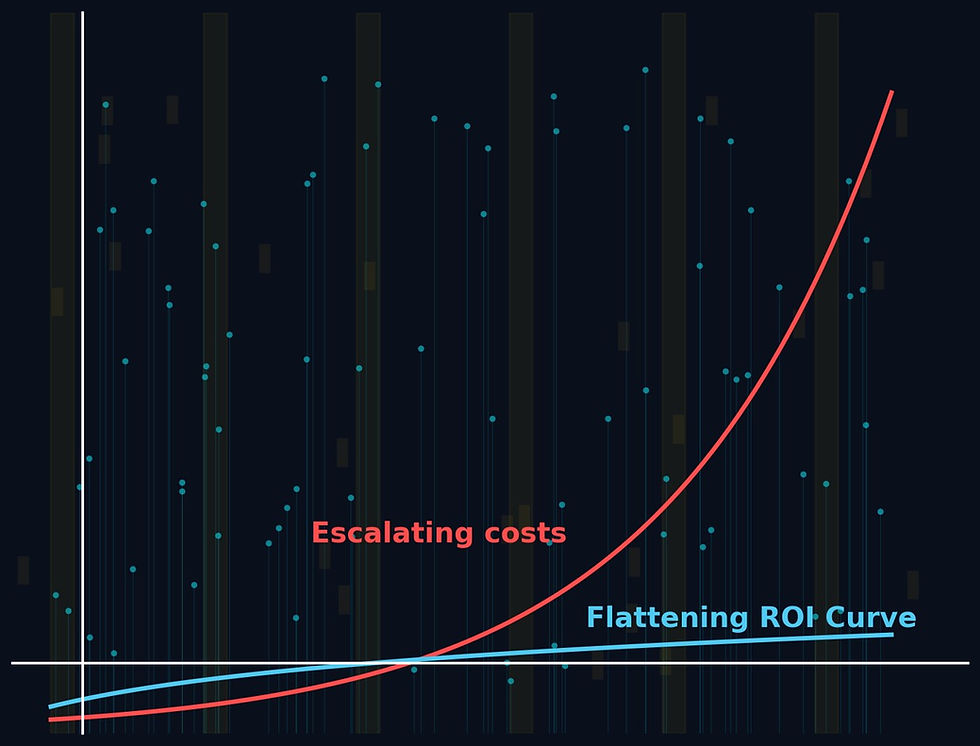

The much-anticipated quarterly results from Microsoft and Meta were considerably stronger than expected (+9% and +7% on the top-line respectively). Mega-cap technology companies (Microsoft, Alphabet, Amazon, and Meta) are all vying for AI dominance. Most analysts will argue that robust revenue will justify the aggressive capital spending, however the competitive pressure to keep leap frogging each other on AI spending has likely created a spiralling cost model arguably with no exit. The key winner in the near term is NVIDIA and the supply chain as the semiconductor chips bought this year are potentially made obsolete by the new ones coming out next year. Under Moore’s law, there is no probably competitive advantage in AI. There is only commodification.

Outperformance of mega-cap tech was tested earlier this year following the release of Deep Seek. The prevailing bias or narrative shifted from “China is nowhere in AI to maybe China has a competitive edge in AI.” Our big picture conclusions at the time were: ) AI gets cheaper, 2) AI requires less power than previously thought; 3) AI proliferates faster; 4) AI winners aren’t who we thought and 5) existing capital expenditure outlays could be very wrong.

The last point caused investors to question trend demand and contributed to a rapid and emotional correction in semiconductor names broadly and NVDIA specifically. The correction commenced well in advance of the April 2nd Liberation Day episode. The good news for the bulls at the time was that the major customers of NVDIA re-affirmed their capital expenditure as large language model enthusiasm transformed cloud demand and the meg-cap tech vied for AI dominance. Indeed, capital expenditure plans among the majors have increased further over the past two quarters.

While the recent revenue and earnings results have been robust for the mega-cap technology companies, it is also well appreciated by the market. The relative price performance of US MSCI Information technology compared to the S&P500 has become non-linear and achieved a new record high well beyond the first technology bubble in 2000 (chart 1). Euphoric non-linear price action and heroic valuation, there is material downside risk if AI does not deliver returns on capital to meet investor expectations.

Chart 1

Source: Bloomberg

To be fair to NVIDIA, the phenomenal share price performance has, so far, been matched by growth in corporate earnings (chart 2). On the negative side, the gross profit margin has probably peaked. Moreover, in contrast to NVDIA, Meta’s earnings have not matched the extraordinary share price performance since 2022 (chart 3). Put another way, there has been valuation multiple expansion on the hope of growth in the future. Jim Chanos also raised an interesting point on the depreciable life of Meta’s capital base. On June 30, 2025, it was 11-12 years on $210 billion. If the true economic life of the GPUs is much shorter (he argued for 2-3 years) Meta’s profits might be materially overstated.

Chart 2

Source: Bloomberg

Chart 3

Source: Bloomberg

As we have argued for some time, there is a divergence between price and fundamentals for the S&P500 more broadly. At 23.3 times 12-month forward earnings, the index also trades in the 90th percentile of its valuation history. The additional potential pressure on valuation is the rise in Treasury yields. The consequence of US growth resilience and the absence of fiscal consolidation is higher Treasury yields. Unless there is a sharp correction in the labour market over the next two months, the Federal Reserve is unlikely to cut the funds rate in September. There has been a notable and related rebound in the US dollar from the recent low. Valuation is not particularly useful on a tactical (shorter) time frame, but there is a distinct absence of risk compensation. The more important tactical signal is non-linear price action and divergence of consensus beliefs from fundamentals. The odds of a near term pull-back or correction have increased. Strategically, the bigger picture opportunity is the supply chain and energy for the AI capital spending arms race.

Comments